Layanan Banner new

Financial Literacy & Inclusion

Breadcrumb

Our Commitment to Increasing Financial Inclusion & Literacy

As the largest commercial bank that focuses on serving Micro and SME customers in Indonesia, BRI recognises that in our role as financial intermediaries we have a contribution to make towards creating and maintaining inclusive societies, which are necessary for achieving shared prosperity for both current and future generations. Therefore, as part of BRI corporate strategy that aims to be The Most Valuable Banking Group in Southeast Asia and Champion of Financial Inclusion in 2025, BRI is committed to increasing financial inclusion and literacy in Indonesia through the following areas:

Equitable Access to Financial Products & Services

Equitable Access to Financial Products & Services

We are committed to providing access to customer-centric and affordable financial products & services to underserved group, including but not limited to those with limited access to financial services provided by formal financial institution, low-income individuals, underprivileged women, students, Indonesian migrant workers, people with disabilities, elderly people, and other underserved groups. We focus on:

- Providing access (through physical and/or digital service points) to financial products & services to the underserved groups based on their characteristics and preferences

- Continuously developing and delivering customer-centric and affordable financial products and services, including but not limited to saving, lending, and insurance products based on the underserved groups' needs and and preferences

- Providing non-financial supports in the form of community empowerment programs to increase financial literacy, promote financial well-being, and scale-up the businesses of the underserved group

- Protecting customers' financial well-being by ensuring that loans are calculated based on customers' ability to pay and ensuring fair treatment of all customers by applying our Fair marketing communication policy principles: Transparency, Fair treatment, Reliability, Confidentiality & Security of Consumer Data & Information, and Handling of complaints and settlement of customer disputes in a simple, fast, and affordable way.

Partnerships

Partnerships

We are committed to maintaining open and respectful relationship and collaboration with internal and external parties in order to increase financial inclusion. Internally, we will continuously develop and train all employees who are directly serving the underserved groups. The development and training programs will include loan analysis techniques, sales techniques, product knowledge, and community development module. Externally, we will collaborate with key stakeholders, including government, regulators, and other external parties that have the same objective in promoting financial inclusion in Indonesia

Good Corporate Governance

Good Corporate Governance

We are committed to strengthening good corporate governance to ensure the processes and outcomes that are necessary to achieve company's goals related to financial inclusion, including by establishing governance oversight on Financial Inclusion.

BRILink Agent

Agent Based Branchless Banking, a sharing economy, agent-based business model that allow our... more

BRI Digital Advisor

Digital Advisors is a new role or culture which made for all of BRI employees to increase customers' digital... more

Co-location (SenyuM Outlet)

Senyum Outlet is an integrated service office between BRI-Pegadaian-PNM that makes it easy for customers... more

Senyum Mobile

Senyum Mobile is an integrated digital sales platform to enable joint-acquisition across 3 entities (BRI... more

BRISPOT

BRISPOT is an Android-based application that allows micro loan decisions to be made online on the spot... more

Teras BRI

BRI Terrace (Teras BRI) serve the micro customers in the frontier and outermost both through information... more

BRILink Agent

Agent-Based Branchless Banking, is a sharing economy, an agent-based business model that allows our selected customers to provide banking services, including basic savings and transactions.

The BRILink service is an expansion of BRI’s services where BRI cooperates with its customers as agents who can serve banking transactions for the public in real-time. The increasing number of people who have access to financial services will directly affect the increase in the number of customers and deposits, thus in turn increasing the potential for loan disbursement. This is inseparable from the massive support and development of information technology carried out by BRI. This not only improves BRI’s services but also implements financial literacy and inclusion, including in Frontier, Outermost, and Disadvantaged (3T) areas.

The distribution of BRILink Agent has brought the community closer to BRI as a financial service provider, thereby contributing to the achievement of the 8 SDGs goals, including supporting inclusive and sustainable economic growth, productive and comprehensive employment opportunities, and decent work for all. Through the BRILink Agent service, the public can also participate in social protection programs for both health and employment, which is an indicator of the achievement of Goal 10 SDGs.

BRI Digital Advisor

Digital Advisors is a new role/culture which made for all of BRI employees to increase customers' digital savviness and to assist them along the continuum of their digital journey”

To improve the financial and digital literacy of BRI’s customers, BRI has a program for all of BRI’s employees (BRILiaN personnel) which required to act as digital instructors. BRILiaN personnel were given preparation and briefing through socialization. The socialization process is carried out to RM (Funds, Credit, Mantri) as an influencer by conducting outreach and education to all employees in work units regarding BRI’s digital products and how to conduct transactions on digital platforms easily and safely.

Digital Advisors' key activities are:

- Digital Acquisition: Encourage customers to do banking transactions through BRI digital platform, e.g. opening digital savings, using BRIMO for daily financial transactions, etc.

- Digital Transaction: Assist customers to perform Financial transactions through IB, Mobile Banking & BRIMO, etc.

- Secured Digital Transaction: Educate customers to have secure financial transactions, ie. by maintaining personal data confidentiality such as biological mother's name, PIN, OTP, CVV, avoid using wifi in public areas, etc.

Co Location (Senyum Outlet)

Senyum Outlet is an integrated service office between BRI-Pegadaian-PNM that makes it easy for customers from the three companies to make transactions according to their respective needs. BRI, Pegadaian, and PNM business ecosystems complement each other in building integrated services for business people through 3 (three) phases, namely "Empower, Integrate and Upgrade". Through this integration, customers can access 3 (three) types of financing products at once, namely group financing (PNM Mekaar); pawn financing (Pegadaian), and micro-loan (BRI, PNM, Pegadaian). BRI also provides several savings products such as micro-savings; microinsurance; gold savings and investment; as well as digital services BRI Mobile Banking (BRIMo). This synergy aims to expand the reach of the Company by providing more complete financial services and easy access to the public.

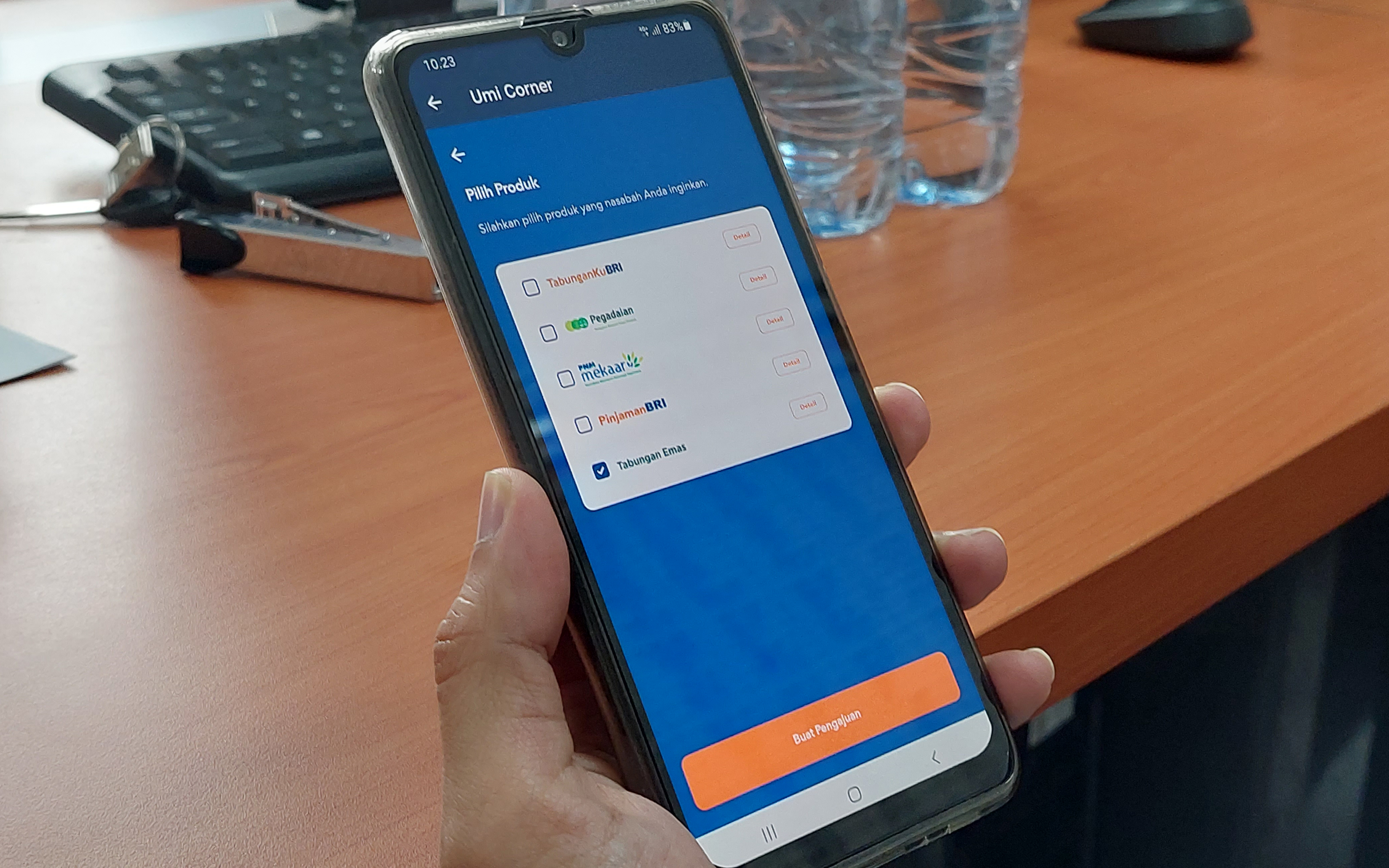

Senyum Mobile

Senyum Mobile is an integrated digital sales platform to enable joint acquisition across 3 entities (BRI, Pegadaian & PNM). Senyum Mobile directly connected the existing applications of BRI, Pegadaian, and PNM, namely BRISPOT (BRI digital loan origination application), Selena (Pegadaian sales pipeline management system), PNM Digi (PNM digital loan origination application) to enable joint acquisition within sales officers in three entities.

This application provides a series of features to access loan, saving, and mortgage services in an efficient and integrated manner. For example, opening a gold savings account through BRI's sales force can be done on the Senyum Mobile application and will be directly connected to Pegadaian's database. Vice versa, customers who wish to apply for a loan through the Pegadaian sales force can use Senyum Mobile to be processed by the BRI KUR program.

Through digital transformation and with the "go smaller, go shorter, go faster strategy" BRI's financing services will continue to be developed so would be more efficient and more affordable cost. BRI hopes that this synergy can help Ultra Micro businesses recover quickly from the impact of the Covid-19 pandemic, as well as increase the penetration of Ultra Micro credit segmentation and the microfinance transaction system in society.

BRISPOT

BRISPOT is an Android-based application connected via the internet that allows the initiation process to loan decisions (especially BRI micro, consumer, and small loans) to be made anywhere and anytime so that the loan process can be carried out more quickly and efficiently. In total BRISPOT has more than 140 features which include sales & pipeline features, automated prescreening, monitoring & evaluation, portfolio balancing through profit & loss dashboards to make it easier for micro loan advisors to do portfolio management, integration with UMI corner, and further development of BRILink Agent partnership feature for increasing referral-based distribution in the micro and ultra micro-segments, as well as an early warning system to increase productivity, efficiency and strengthen risk management.

Currently, BRISPOT has been used by more than 47 thousand BRI loan officers and loan approvers, which have proven capable of supporting BRI's business productivity and efficiency. For example, the increase in the number of debtors that can be managed by one Micro Loan Officer has increased dramatically, from before BRISPOT only 334 borrowers per Micro Loan Officer to 517 borrowers.

Teras BRI

Teras BRI is a business unit dedicated to reaching people who live far from BRI branch office facilities. In this program, there is also BRI Mobile Terrace, a mobile service to make it easier for customers to make transactions, as well as BRI Ship Terrace which is aimed at people who live in Frontier, Outermost and Disadvantaged (3T) areas. In 2021, the number of Teras BRI services was 1,697, including 132 Teras BRI Keliling (land vehicles) and 4 on Ships.

Desa BRILian

BRI continues to pay attention to the level of literacy and lack of access of rural communities... more

Klaster Hidupku

Klaster Hidupku is a pattern of marketing approach to certain micro communities that is carried out... more

Link UMKM

As a commitment to MSME development, BRI has built an integrated online platform called LinkUMKM... more

UMKM Expo (RT)

It began with BRI’s involvement in the G-20 series in the form of a side event by presenting... more

Desa BRILian

BRI continues to pay attention to the level of literacy and lack of access of rural communities to banking products and services. Therefore, BRI presents an incubation and literacy program called Desa BRILiaN by inviting and optimizing the role of village-owned enterprises (BUMDes). The Desa BRILiaN program aims to set an example in collaborative village development efforts based on Sustainable Development Goals (SDGs).

Apart from being an intermediary for financial literacy and inclusion activities, The Desa BRILiaN program also aims to acquire BUMDes business potential as BRILink Agents and UMi Agents. To ensure that the program runs well, BRI places one BRI Marketing Unit (Mantri) for each village whose role is to assist and assist business actors in developing their business.

BRILiaN Village is a combination of four ecosystem aspects, namely:

- BUMDes: BUMDes actively plays a role as a driving force for the village economy, one of which is in utilizing village funds for productive activities

- Digital: Digitalization implemented in villages, including digital finance and utilization of BRI digital products (BRILink Agent, Web Market, Stroberi)

- Innovation: Villages that are creative in solving village social and social problems

- Sustainability: Tough villages that are able to continuously improve the welfare of its people with the leading sector of the villages.

In 2022, BRI empowered 2,182 BUMDes spread across Indonesia.

Klaster Hidupku

Klaster Hidupku is a pattern of marketing approach to certain micro communities that is carried out effectively and efficiently by establishing groups known as “Klaster Usaha” (business clusters). Those groups are established based on common interests and similar environmental conditions (social, economic, resources, location) and/or familiarity. The groups have a number of criteria, such as:

- The number of business players is at least 8 people;

- Regional similarities between business actors, namely RT (neighborhood unit), RW (community unit), and villages; as well as

- Having similar business or commodities.

To make the program more effective, BRI digitizes the Klaster Usaha data management by building a database. The data system contains a number of data regarding the Superior Clusters, namely clusters that are intensively assisted by BRI Mantri Units and have received empowerment program support from BRI.

Through Klaster Hidupku, BRI provides assistance by building facilities and infrastructure, as well as training to support their business development. BRI also regularly holds bazaars every month to expand market access by introducing fostered MSME products, as well as to inspire more MSME players to join the Klaster Usaha with BRI.

Link UMKM

As a commitment to MSME development, BRI has built an integrated online platform called LinkUMKM to empower small and micro entrepreneurs and assist them in running their businesses. Aimed at bringing convenience, dcan be accessed through websites and applications and has complete features to help MSME players improve the quality of their products through various free training and market their products to the public.

The platform can also show the class and category of MSME businesses through the “UMKM Assessment” feature and provide a series of modules for developing businesses that are available on the UMKMSmart menu. The business category consists of:

- Traditional

- Developing

- Modern

UMKM Expo (RT)

It began with BRI’s involvement in the G-20 series in the form of a side event by presenting the “Road to Brilianpreneur 2022” showcase at Apurva Kempinski, Bali in November 2022. The UMKM EXPO(RT) BRILIANPRENEUR 2022 took place offline on 14-18 December 2022 at Jakarta Convention Center (JCC) as well as online from 2-31 December 2022 through the website www. brilianpreneur.com, the BRI YouTube channel and the detik.com website. This event was a manifestation of BRI’s commitment to increasing social value creation by playing an active role in encouraging progress, increasing the capabilities and quality of MSMEs and MSME products in Indonesia, so that Indonesian MSME products could compete in domestic and foreign markets.

Attended by the Minister of Cooperatives and SMEs of the Republic of Indonesia Teten Masduki, Minister of Tourism and Creative Economy of the Republic of Indonesia Sandiaga Uno, and Main Director of BRI Sunarso, the UMKM EXPO(RT) BRILIANPRENEUR 2022 this year carried the theme “Bring MSMEs Indonesia to the World” which reflected BRI’s commitment and optimism to continue to support MSMEs to upgrade to become part of the global market.

Of the 1,189 MSMEs that registered this year, 502 MSMEs were selected consisting of 105 MSMEs in the Home Decor and Craft category, 168 MSME in the food and beverage category, 125 MSME in the Accessories and Beauty category, 74 MSME in the fashion and textiles category, and 28 MSME in the healthcare/wellness category. (28) and 2 SMEs in the Digital Technology (Startup) category. This year’s selected MSME participants came from 115 districts/cities and 22 provinces in Indonesia. Prioritizing inclusivity, the BRILIANPRENEUR UMKM EXPO(RT) 2022 also involved 262 women entrepreneurs and 5 (five) entrepreneurs with disabilities.

UMKM EXPO(RT) BRILIANPRENEUR 2022 consisted of online expo, online bazaar in marketplace, live shopping, coaching clinic, podcast, creativity event, virtual business matching, MSMEs meeting event, culinary event, sharing talk show with cultural, business and marketing practitioners to giving appreciation for SMEs.

This activity featured superior products from 502 selected MSMEs from Indonesia. Total visitors who came offline were 19,276 people and online were 181,339 people. Online bazaar activities on the marketplace have recorded transactions of 17.1 billion in 1 month. The Brilianpreneur 2022 event not only captivated the national market, the various MSME products also attracted international market interest, which was represented by 43 buyers from 20 countries. In this year’s business matching, there were 241 business matching activities with deals of up to USD 76.7 million.